doordash business address for taxes

Adding up your income including W-2 Doordash earnings and other income. A 1099-K form summarizes your sales activity as a Merchant.

The Complete Guide To Doordash 1099 Taxes In Plain English 2022

You are considered as self-employed and in IRS parlance are operating a business.

. Ad Find out what tax credits you qualify for and other tax savings opportunities. DoorDash drivers can deduct their mileage by either claiming the federal reimbursement for mileage 56 cents per mile in 2021 or by claiming actual expenses. Get a personalized recommendation tailored to your state and industry.

An Employer Identification Number EIN is also known as a Federal. Business Address Postal Code ZIP Phone. Ad Find out what tax credits you qualify for and other tax savings opportunities.

Each year tax season kicks off with tax forms that show all the important information from the previous year. Is a corporation in San Francisco California. The Federal Insurance Contributions Act FICA requires a tax on employees wages as well as contributions from employers in order to fund the USs Social Security and.

The employer identification number EIN for Doordash Inc. EIN for organizations is sometimes also referred to as. 1 Best answer.

It should be included in the 1099 info that Doordash sends you. A 1099 form differs from a W-2 which is the standard form issued to. If you used a subcontractor and paid them more than 600 you are required to send a 1099 form to them and the IRS.

As a Dasher you are considered a. - All tax documents are mailed on or before January 31 to the business address on file with DoorDash. Choose the expanded view of the tax year and scroll to find Download Print Form just above the Close button.

The questions will be broken up in five groups. 303 2nd St Suite 800. The main DoorDash address belongs to the main headquarters in San Francisco.

All you need to do is track your mileage for taxes. March 18 2021 213 PM. Part 1 of filing.

Yes - Just like everyone else youll need to pay taxes. A 1099-NEC form summarizes Dashers earnings as independent. Its provided to you and the IRS as well as some US states if you have.

Your biggest benefit will be the. This is the reported income a Dasher will use to file their taxes and what is used to file DoorDash taxes. This means you will be responsible for paying your estimated taxes on your own quarterly.

Get a personalized recommendation tailored to your state and industry. Take note of how many miles you drove for DoorDash and multiply it by the Standard Mileage deduction rate. 4 rows A 1099 means you get taxes as a business owner.

Your FICA taxes cover Social Security and Medicare taxes 62 for Social Security and 145 for Medicare. Please contact the moderators of this subreddit if you have any questions or concerns. Income from DoorDash is self-employed income.

The full mailing address is listed below. You will pay to the Federal IRS and to the State separate taxes. Internal Revenue Service IRS and if required state tax departments.

That is when you would check yes. 34 rows Business Address State ZIP. The first section of.

If you earned more than 600 while working for DoorDash you are required to pay taxes. You pay 153 SE tax on 9235 of your Net. Schedule C Form 1040 is a form that one must fill as part of their annual tax return when they are sole proprietors of a business.

Tax Identification Number and is used to identify a business. FICA stands for Federal Income Insurance Contributions Act. Paper Copy through Mail.

Youll receive a 1099-NEC if youve earned at least 600. Does DoorDash provide a 1099. If youre a Dasher youll need this form to file your taxes.

The only tax form that eligible Dashers will receive is the 1099-NEC and this is ONLY for Dashers who earned 600 or more on the platform in 2021Dashers who earned less. The forms are filed with the US. Tap or click to download the 1099 form.

It doesnt apply only to DoorDash. It may take 2-3 weeks for your tax documents to arrive by mail. Self Employment tax Scheduled SE is automatically generated if a person has 400 or more of net profit from self-employment.

Does DoorDash send you.

Doordash 1099 Critical Doordash Tax Information For 2022

Doordash Launches In Montreal Its First French Speaking Market

How To Claim Doordash On Taxes In Canada Quora

How To Get Doordash Tax 1099 Forms Youtube

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

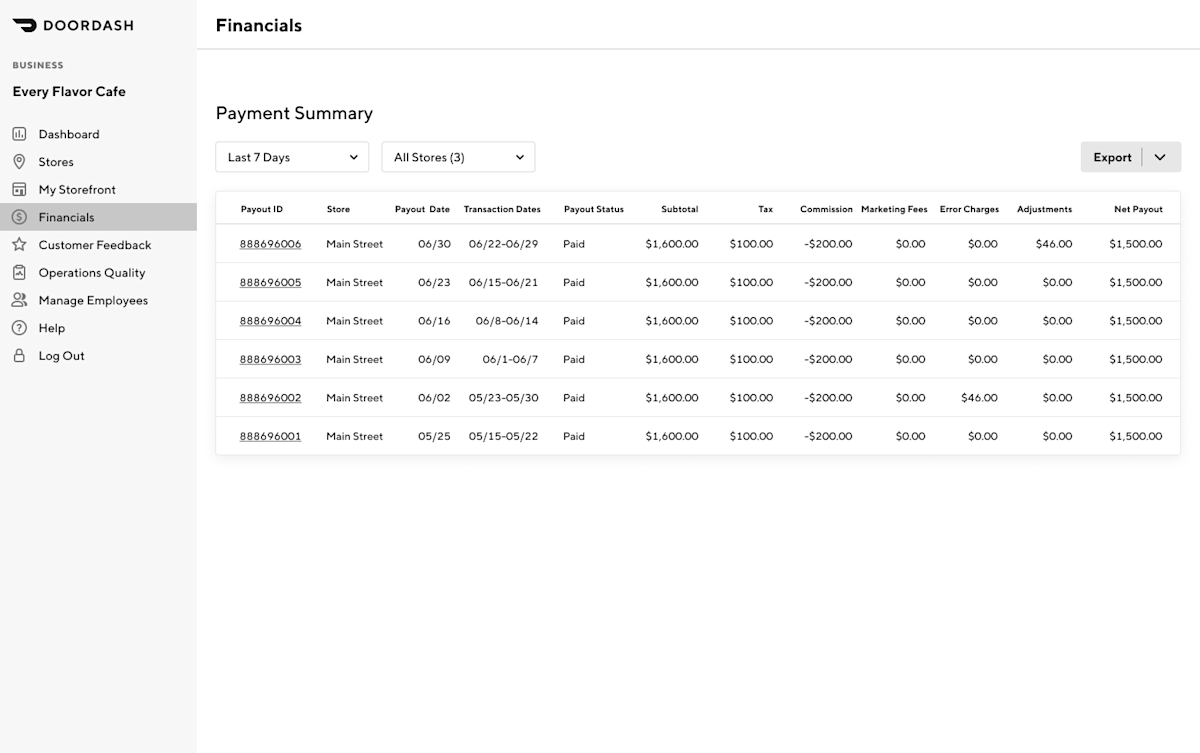

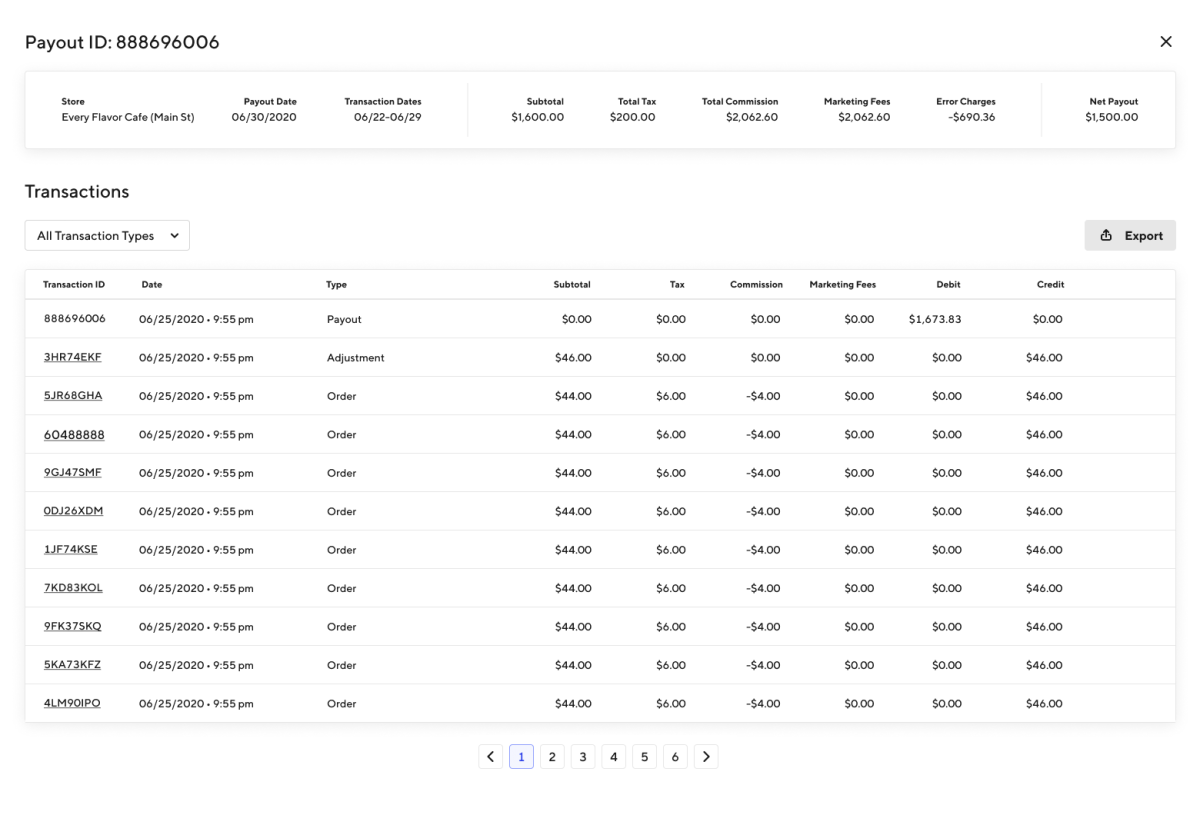

Prepare For Tax Season With These Restaurant Tax Tips

Prepare For Tax Season With These Restaurant Tax Tips

A Beginner S Guide To Filing Doordash Taxes 4 Steps

How Do Food Delivery Couriers Pay Taxes Get It Back

Doordash Is Now In Ottawa But It S Much More Costly Than Ubereats R Ottawa

How Can I View My Delivery History With Doordash

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

How Do Food Delivery Couriers Pay Taxes Get It Back

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

How To Do Taxes For Doordash Drivers 2020 Youtube

Doordash 1099 Critical Doordash Tax Information For 2022

Guide To 1099 Tax Forms For Doordash Dashers And Merchants Stripe Help Support

Doordash Taxes Schedule C Faqs For Dashers Courier Hacker

I Began Doing Doordash Last Year And Am Filing My Taxes In A Few Weeks I Saw On The Doordash Website Section About Taxes That Milage Info Would Be Sent Out On